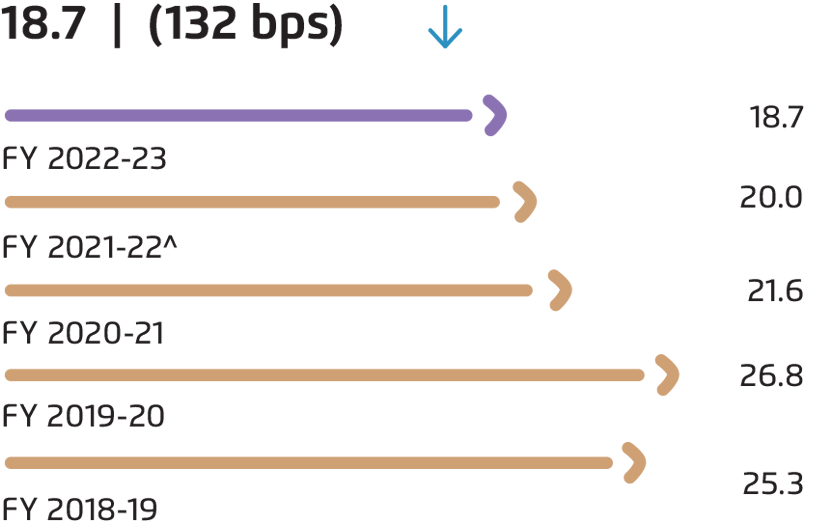

(excluding exceptional items)

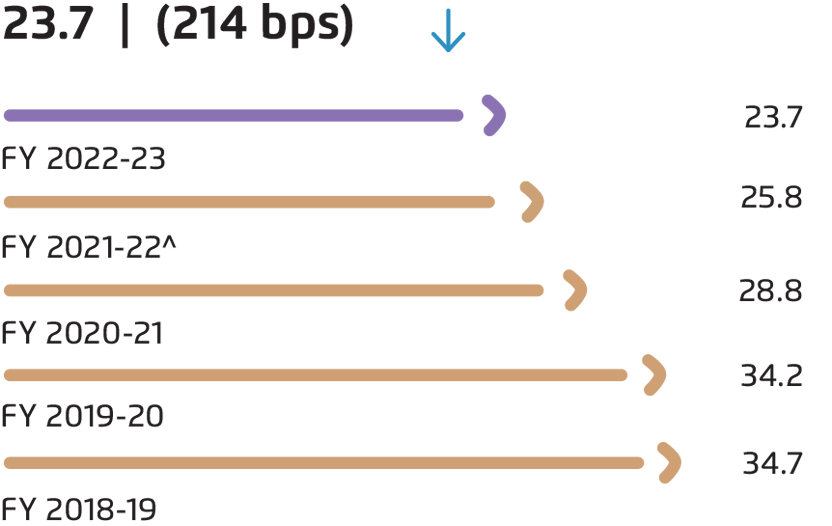

(excluding exceptional items)

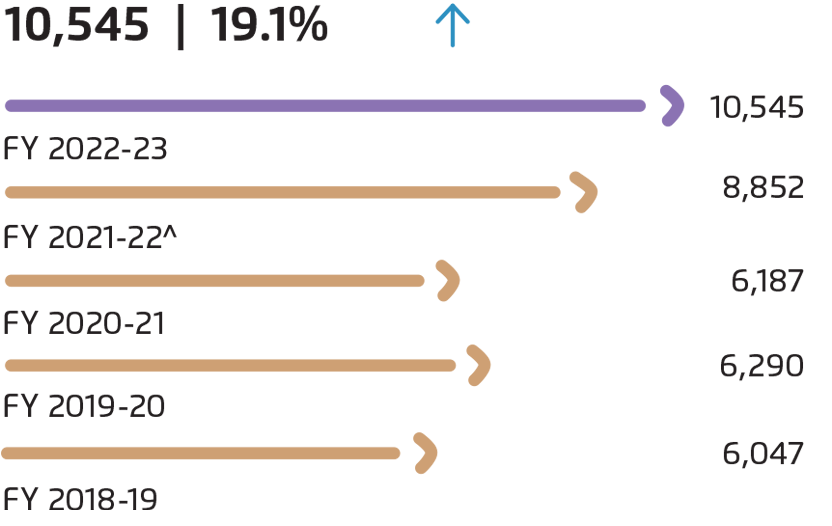

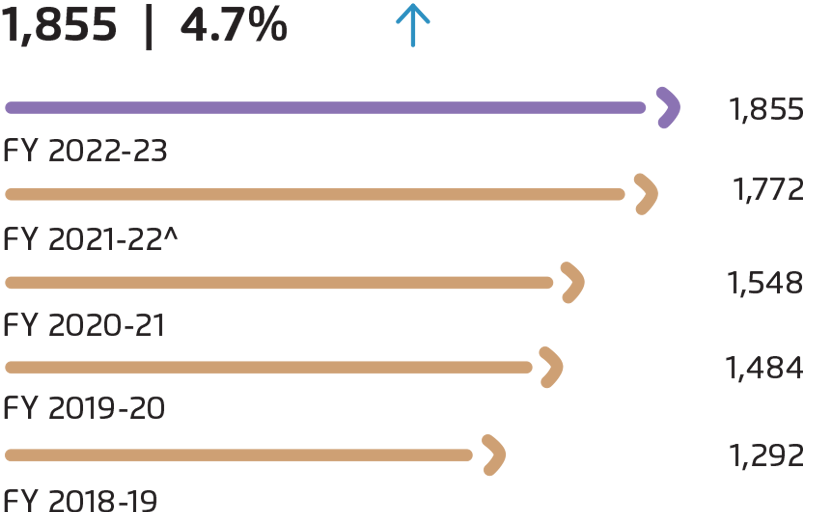

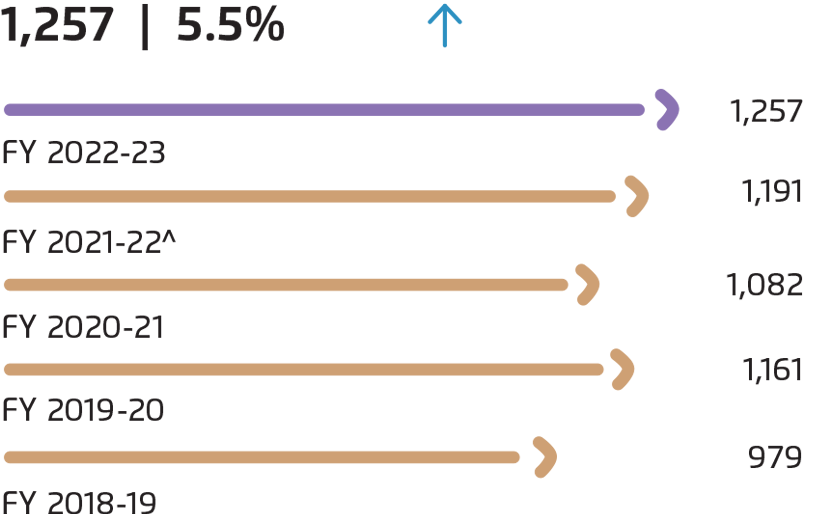

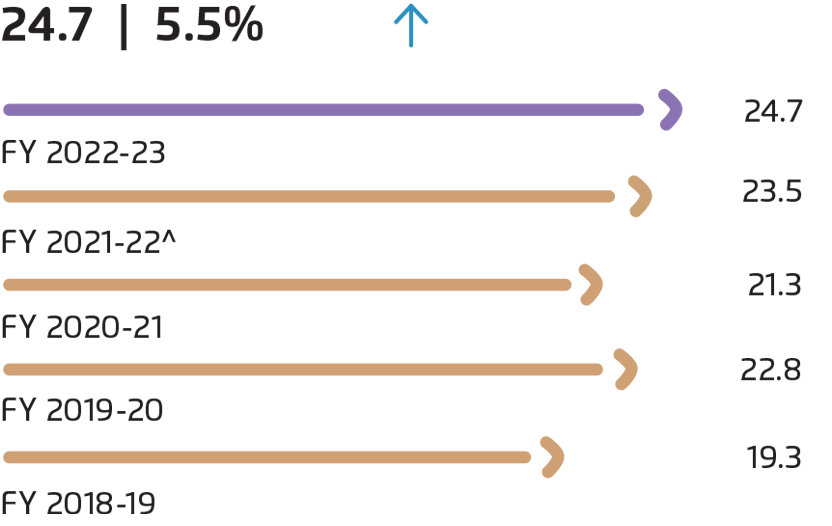

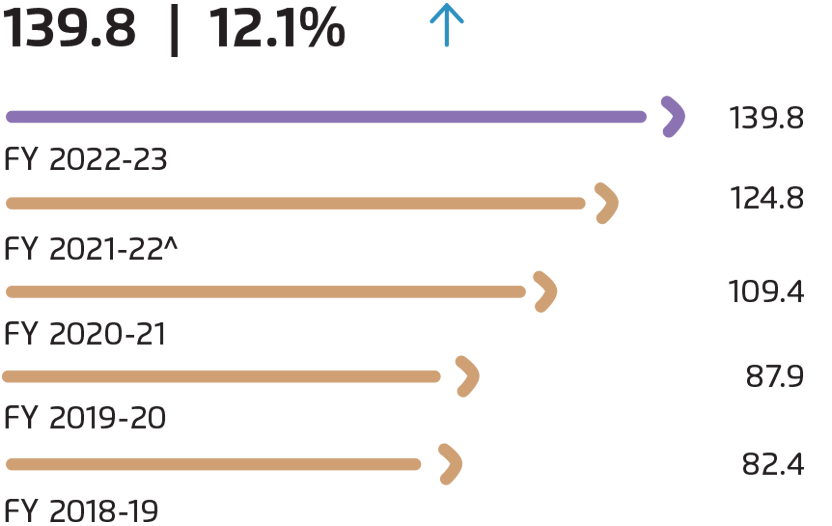

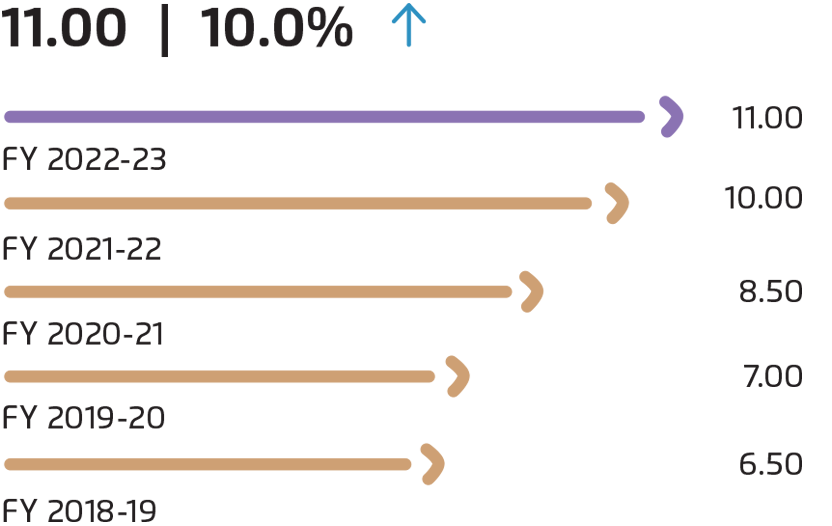

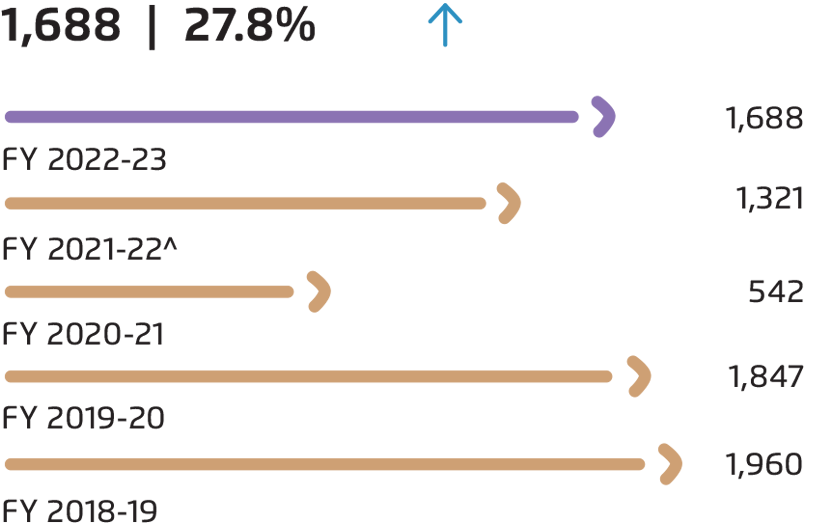

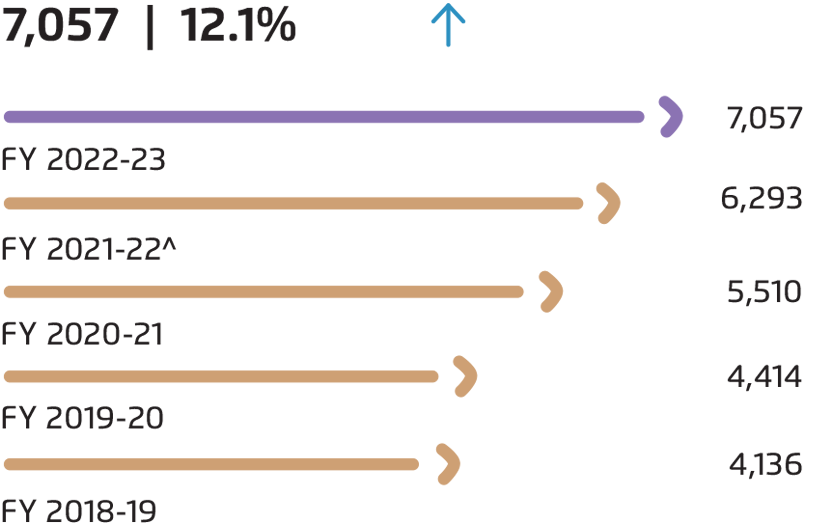

![]() Y - O - Y Growth/Degrowth

Y - O - Y Growth/Degrowth

^ Previous year’s figures restated on account of merger (refer Note 56 of Standalone Financial Statements)

* EBITDA = Profit Before Tax before exceptional items (PBT) + Finance Cost + Depreciation - Other Income

Distribution

of Revenue

2022-23

^ Previous year’s figures restated on account of merger (refer Note 56 of Standalone Financial Statements)

^ Previous year’s figures restated on account of merger (refer Note 56 of Standalone Financial Statements)